2025

Year in review

Reaching new heights in private equity in Israel

A Year of

Building Value

In 2025, assumptions were tested, discipline was rewarded, and the importance of long-term conviction was reaffirmed.

Against a backdrop of geopolitical uncertainty, volatile markets, and rapidly shifting technological and economic landscapes, we remained focused on our core values and our mission: identifying resilient businesses and creating sustainable growth.

This year in review reflects some of the milestones achieved by our funds and portfolio companies, and the foundations laid for future opportunity. As we look back on 2025, we do so with appreciation for the trust of our investors, the dedication of our management teams and a renewed commitment to building long-term value in the years ahead.

6

Funds to date

$2.7B

Amount raised

21

Years since inception

Our fund at a glance

>120

Investments and platforms

Active portfolio companies

A year of growth

CEO reflections

"There was not a single day in 2025 when our manufacturing sites and logistics operations were interrupted. Despite significant local challenges, we maintained full supply and distribution of our medicines with no shortages.

I am also proud of our strong new product pipeline, alongside significant growth in our branded portfolio, including the launch of Taftafim+ and the full rebranding of our VMS portfolio, HADAS."

Iftach Seri

CEO of CTS

"In 2025, Cellcom doubled its share price and increased its market value from roughly NIS 2B to nearly NIS 6B, while continuing to deliver consistent quarter-over-quarter improvements in net profit - achievements that enabled the company to resume dividend distributions for the first time since 2013, with a NIS 200M payout. The year also marked a substantial brand transformation that reinforced the company's Israeli identity and strengthened its position as the leading operator in the Israeli communications market."

Eli Adadi

CEO of Cellcom

"2025 has been a standout year as the Stratasys team continues to drive a shift in additive manufacturing from technology for its own sake to practical solutions that deliver real value for manufacturers. AM is becoming a critical component of the manufacturing ecosystem across aerospace and defense, automotive and healthcare, reflected in a 24 percent growth in use cases across key industries this year."

Yoav Zeif

CEO of Stratasys

"Building on years of strong momentum in Israel, Oncotest, a division of Rhenium Group, continued in 2025 to drive leadership in precision medicine and work closely with the healthcare system. With the launch of Galleri, the world’s first multi-cancer early detection blood test, we have expanded access to life-saving innovations and advanced our mission of personalized care for all.”

Lior Soussan-Gutman, PhD

CEO of Oncotest by Rhenium Group

"In 2025, I’m most proud of building and strengthening our management team, aligning the right people around a shared purpose, and establishing a leadership culture of trust, accountability, and collaboration. This has strengthened our connection with customers and positioned the company for long-term sustainable growth."

Tali Chen

CEO of Solcon

“Since launching EasySave in 2025, I’m proud to report that over 100,000 unbanked individuals have begun saving for tuition and other life-changing goals. We have also increased the share of arm’s-length capital in our credit business, showing that impactful businesses can be financially viable.”

Alon Eitan

CEO of Fido

“Cello strengthened its position in the B2B segment in 2025 through dedicated fleet products and a strategic acquisition. This momentum reinforces our vision of creating a single, seamless platform that connects every aspect of parking and mobility.”

Guy Selok

CEO of Cello

“At MotoRad, I’m very proud of our team’s response to the US tariffs, which had the potential to significantly impact both our customers and our P&L. Our sales, supply chain, and operations teams worked proactively to maintain our economics in a way customers appreciated. In 2025, we also transformed inventory management with advanced analytics, sharply reducing planning time and resources. The improved insights are already driving meaningful inventory reductions.”

Steve Skinner

Executive Chairman of MotoRad

2025

Exits & partial realizations

In 2025, we continued to actively realize value across the portfolio through exits and partial realizations, while completing 10+ add-on investments to accelerate growth. We invest in businesses with strong market positions and clear growth trajectories, applying a hands-on, fundamentals-driven approach to drive transformation and long-term value creation.

Sold to

Accord Plasma B.V. (part of Intas Group)

Sold to

TeamSystem

Sold to

EW Group

Sold to

XTEND

IPO (TASE: SUGT)

Total portfolio employees

~15,000

across multiple industries

9.7%

Health

10.5%

Software / Cloud

8.6%

Food-Tech /

Ag-Tech

12.8%

Digital Print

5.1%

Industrial

24.5%

Digital Services

28.9%

Communications

/ Electronics

We saved 22M NIS through group purchasing

Driving cost efficiency at scale

We leverage our collective purchasing power to secure preferential commercial terms across key operational categories. By aggregating demand, we enable our companies to access best-in-market pricing and conditions on everything from office real estate and business travel to vehicle leasing and essential office services.

AI Transformation

Actively engaged in integrating AI solutions

Deployed AI solutions in their offering or operations

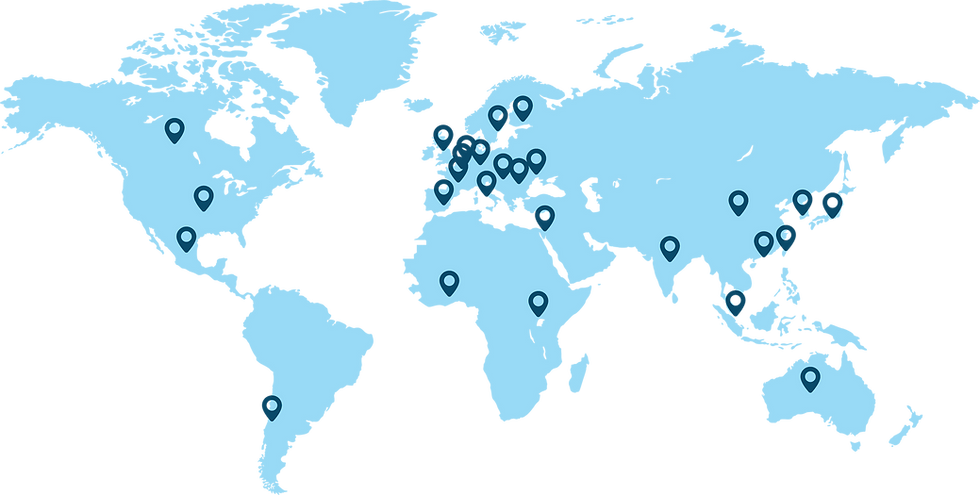

Geographical footprint

27+

portfolio sites worldwide

Executive forum events

Our executive forums play a central role in bringing Fortissimo’s senior portfolio executives together. These events create a shared space for leaders to stay updated on recent investments and realizations, gain external perspective, and engage with the themes shaping their businesses, from strategy and value creation to macroeconomic trends, AI in enterprise, and operational transformation.

2

Executive forum events

500+

Senior portfolio executives

7

Dynamic break-out sessions

6

ESG Forum events

2.3M+

NIS

Total charitable contributions across the portfolio

95%

Companies expanded ESG initiatives

4,500+

Total hours of volunteering across the portfolio in 2025

Building on the momentum of 2025

Moving forward

with conviction

As we move into 2026, we do so with confidence in the foundations built over the past year and the progress achieved across our fund and portfolio companies. We remain optimistic about the opportunities ahead and are well positioned to build on our successes and continue delivering sustainable growth. We enter the year ahead with clarity of purpose and confidence in a brighter future.